Our Services

Strategic & Qualified Introductions

We connect your business with pre-qualified partners, clients, or key institutions, based on a deep understanding of your specific commercial objectives.

Access to Sector-Specific Specialists

We provide direct access to key local players, enabling you to gain the practical, on-the-ground insights you need without intermediaries or second-hand information.

Local Operations Support

We provide hands-on support with agenda management, meeting logistics, and facilitation to ensure your key commercial and governmental interactions are a success.

Market Entry Advisory & Navigation

We provide initial guidance to navigate the business landscape, regulatory frameworks, and cultural nuances, ensuring you start on the right path.

Industries

The drivers of growth in our nations.

INDUSTRIES

This is the space to introduce the Services section. Briefly describe the types of services offered and highlight any special benefits or features.

01

Customer-Centric Focus

This is the space to introduce the Services section. Briefly describe the types of services offered and highlight any special benefits or features.

02

Commitment to Security

This is the space to introduce the Services section. Briefly describe the types of services offered and highlight any special benefits or features.

03

Transparent and Fair Practices

This is the space to introduce the Services section. Briefly describe the types of services offered and highlight any special benefits or features.

INDUSTRIES

Two-factor

This is the space to introduce the Services Briefly describe the types of services offered.

Data encryption

This is the space to introduce the Services Briefly describe the types of services offered.

Text alerts

This is the space to introduce the Services Briefly describe the types of services offered.

INDUSTRIES

Saudi Arabia's energy sector is undergoing a profound transformation, driven by the nation's ambitious vision for economic diversification. The kingdom is not only reinforcing its leadership in crude production but is also evolving into a vertically integrated powerhouse that spans the entire value chain, from hydrocarbon extraction to the manufacturing of high-value petrochemical products. This approach aims to position the country beyond its traditional role, establishing it as a global energy and petrochemical hub.

Saudi Aramco, the global energy giant, is at the heart of this strategy. With revenues of approximately $434 billion and a net income of $106.2 billion in 2024, the company is not only the world's leading crude exporter but also maintains one of the largest spare capacities, at approximately 1 million barrels per day. This gives it unparalleled flexibility and resilience against global market fluctuations. Its expansion into refining and petrochemicals sets it apart from other producers, maximizing the value of its exports.

This diversification is being reinforced through strategic partnerships with international companies, a key advantage for the sector. Examples of these collaborations include SATORP, a joint venture with TotalEnergies that operates a 460 kb/d refinery, and Petro Rabigh, a partnership with Japan's Sumitomo Corporation, which manages a 400 kb/d complex. These ventures not only boost the production of fuels and polymers but also solidify Saudi Arabia's position as a leading petrochemical center, comparable in sophistication and scale to major global players.

The country's strategy, aligned with its Vision 2030, demonstrates a clear commitment to a more sustainable and resilient energy future, built on a foundation of innovation, vertical integration, and the creation of a high-value industrial ecosystem that secures its long-term leadership.

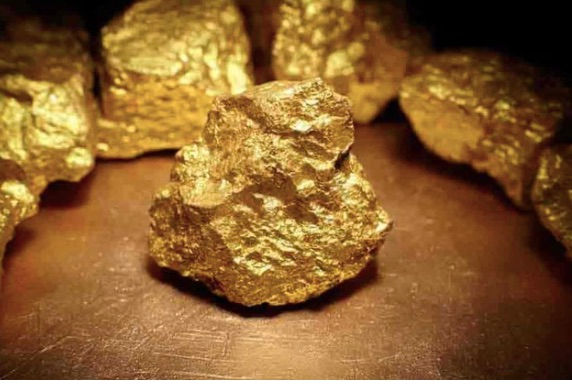

Saudi Arabia’s mining and jewelry sector is emerging as a fundamental pillar of the country's economic diversification. Driven by Vision 2030, the kingdom is capitalizing on its vast mineral reserves, with a particular focus on gold, to strengthen its industry and position itself as a key player in the global market. This evolution is reflected in the modernization of mining and the flourishing of the luxury jewelry industry.

At the forefront of this transformation is Ma’aden Gold, a key business unit of the country's main mining company. Operating mines such as Mahd Ad Dahab and Ad Duwayhi, the company has significantly increased its gold reserves through aggressive exploration programs. With an estimated production of around 330,000 ounces in 2024, Ma'aden is elevating Saudi Arabian mining capacity to a level comparable with other global producers, using cutting-edge technology for both open-pit and underground mining. This not only generates revenue but also attracts foreign investment and technical expertise to the sector.

Complementing the mining boom, the jewelry industry has reached a notable level of sophistication. L’azurde, a leading jewelry designer and manufacturer in the Middle East, is a benchmark in this field. With a large factory in Riyadh, the company imports precious stones and metals to create high-end gold and diamond jewelry exported throughout the MENA region. This business model, which combines the import of high-quality raw materials with state-of-the-art local manufacturing, demonstrates Saudi Arabia’s potential to become a hub for luxury jewelry design and production.

The joint development of the mining and jewelry industries, led by companies like Ma'aden and L'azurde, underscores Saudi Arabia's commitment to creating a robust and diversified economy. By strategically leveraging its natural resources, the kingdom is building a high-value industrial ecosystem to secure its position as a long-term leader in the global market.

Saudi Arabia's food and beverage sector is undergoing a transformation driven by a vision of self-sufficiency and diversification. With significant investments and a focus on high-value products, the kingdom aims not only to meet domestic demand but also to position itself as a quality producer and exporter in key markets. This strategy is evident in the development of its coffee industry and the consolidation of leading brands in tea and condiments.

Leading this initiative is the Saudi Coffee Company, an entity backed by the Public Investment Fund (PIF). With a $320 million investment, the company is dedicated to developing a domestic coffee industry, with a goal to increase production from the current 300 to 2,500 tons per year by 2028. This effort not only supports farmers in the Jazan region to cultivate the prestigious Khawlani Arabica variety but also establishes an integrated value chain, from processing to exporting Saudi-origin beans. This strategic approach sets the country apart from other coffee importers, creating a unique and high-value identity.

While coffee gains ground, established brands like Rabea Tea and Al Alali continue to dominate the food and beverage landscape. Rabea Tea, headquartered in Jeddah, is a major player that imports bulk tea from countries like Kenya and India to package and export its branded products across the Gulf region. Similarly, Al Alali, a fast-moving consumer goods (FMCG) brand, imports raw materials like spices and tomato paste to produce a wide range of condiments that it exports to GCC markets. The success of these companies highlights the country’s logistical and packaging capabilities, reinforcing Saudi Arabia’s potential to become a regional hub for food production and distribution.

The combined growth of these companies demonstrates that Saudi Arabia's strategy in the food and beverage sector is comprehensive, blending investment in nascent industries like coffee with the consolidation of leadership in established categories.

Saudi Arabia's horticulture and floriculture sector is experiencing significant growth, driven by demand from large-scale infrastructure projects and a booming market. Investments in cold-chain technology and specialized knowledge in cultivating both local and exotic species are positioning the kingdom as a key distribution and production hub. This dynamism highlights the country's vision for developing a green and sustainable economy.

At the forefront of this industry is the Black Tulip Group, a regional player that dominates the market for ornamental flowers and plants. The company specializes in importing cut flowers and indoor plants, primarily from Kenya, Ethiopia, and Europe. Its robust infrastructure, which includes state-of-the-art cold-chain warehousing and a wholesale distribution platform, allows it to supply fresh products to supermarkets, hotels, and event companies across the country. This logistical capability not only meets domestic demand but also sets a standard of efficiency for the sector.

Complementing Black Tulip Group's work, Nursery & Plants Co. (NAP) stands out as one of the kingdom's largest nurseries. NAP is a strategic supplier of palms, shrubs, and landscaping plants for Saudi Arabia's ambitious mega-projects, such as NEOM and the Riyadh revitalization. The company imports ornamental species and propagation material to enrich the landscape design of these projects while also exporting desert-adapted plants to neighboring countries. Its landscape design and installation capabilities underscore the country's technical expertise and long-term vision for creating sustainable and aesthetically pleasing urban environments.

The growth of companies like Black Tulip Group and NAP demonstrates that Saudi Arabia's horticulture sector is strategically positioned to meet the needs of its internal development while building a specialized export capacity.

Saudi Arabia’s agricultural sector is solidifying its growth, with a particular focus on date production—a key cultural and economic pillar. Through investment in technology and value-chain integration, the country is not only ensuring its food security but also positioning itself as a key exporter of high-quality products to global markets. This strategic advancement highlights the kingdom’s ability to diversify its economy and modernize its agriculture.

Leading this transformation is NADEC (National Agricultural Development Co.), an integrated agri-food company that covers everything from production to packaging. NADEC operates thousands of hectares of orchards and date palms, giving it full control over quality from the source. In addition to exporting juices and dairy products to GCC markets, the company is capitalizing on the growing global demand for dates. Its modern packing plants and logistical capabilities reinforce its position as a dominant regional player.

Complementing NADEC’s leadership, companies like Qootof Altamr and Nakhlah Food Industries specialize in the production and processing of premium dates. These companies have successfully positioned exclusive varieties like Medjool and Sukkary in the international market, exporting them in various forms, including whole fruit, paste, and syrup. Their capabilities in sorting, cold storage, and private-label packing allow them to meet the most demanding quality standards. The focus on excellence and added value demonstrates Saudi Arabia's ambition to be recognized not just for the quantity but for the quality of its agricultural products.

The combined development of companies like NADEC, Qootof Altamr, and Nakhlah Food Industries demonstrates Saudi Arabia’s commitment to leveraging its agricultural strengths to build a robust and globally competitive food industry.

Saudi Arabia's chemicals and plastics sector is solidifying itself as a fundamental pillar of the country's diversified economy. With industrial giants that dominate the global market, the kingdom not only produces on a massive scale but also invests in cutting-edge technology to maintain its leadership. This industry is key to the country's strategic vision of transforming its vast hydrocarbon resources into high-value products.

At the forefront of the sector is SABIC, one of the world's largest chemicals and plastics producers. In 2024, the company reported revenues of approximately $37 billion and a net income of around $410 million, consolidating its profitability. With a production capacity exceeding 53 million tonnes per year, SABIC exports a wide range of products, from polyethylene and polypropylene to specialty resins, to markets worldwide. Its integration with Aramco ensures a stable supply of feedstocks, a significant competitive advantage over other global producers.

The Saudi petrochemical ecosystem is strengthened by key players such as Tasnee and the Advanced Petrochemical Company. Tasnee, with its complex in Jubail, is a major exporter of polypropylene and its derivatives, with a strong presence in Asia and Europe. Meanwhile, the Advanced Petrochemical Company, also based in Jubail, produces polypropylene with an annual capacity of approximately 450,000 tonnes and is investing in new plants to expand its portfolio. These companies demonstrate the country's commitment to innovation and growing production capacity, securing its position as a global hub for manufacturing and exporting high-value petrochemical products.

Saudi Arabia’s industrial sector has established itself as a world-class manufacturing and logistical hub, driven by robust production capabilities and strategic partnerships. The kingdom not only meets its domestic demand but also exports high-tech products and services to key markets, reaffirming its role in the global economy.

The sector is anchored by Zamil Industrial, a conglomerate that offers integrated engineering solutions, from HVAC systems to pre-engineered steel buildings. Its export capacity to over 55 countries highlights its global reach and focus on quality. Meanwhile, alfanar specializes in manufacturing low-, medium-, and high-voltage electrical equipment and acts as a key contractor for power projects, including renewables, which reinforces its role in the country's energy transition.

The cable industry is led by Saudi Cable Company (SCC) and MESC. SCC produces power and telecommunications cables and has the capacity to manufacture high- and extra-high-voltage varieties for utility projects worldwide. MESC, on the other hand, focuses on specialized cables for sectors like oil & gas and petrochemicals. This dual approach, from large-scale production to niche specialization, ensures the kingdom's competitiveness.

In machinery, companies like Abdul Latif Jameel Machinery and Saudi Diesel Equipment Co. are vital. Abdul Latif Jameel is the exclusive distributor for Komatsu, offering support and parts through the world's largest service center in Jeddah. Meanwhile, Saudi Diesel Equipment Co. supplies generators and construction equipment from leading brands, demonstrating the logistical and service infrastructure that drives the country's ambitious development projects.

Saudi Arabia's aluminum sector has established itself as a major global player. Through a fully integrated production chain, the kingdom not only leverages its mineral resources but also invests in cutting-edge technology to transform raw materials into high-value products, solidifying its position as a key industrial hub.

At the heart of the industry is Ma’aden Aluminium, a joint venture with Alcoa. Its operations in Ras Al Khair cover the entire value chain, from a bauxite mine to an alumina refinery, a smelter, and a rolling mill. With this, the company exports aluminum ingots and sheets to global markets, ensuring full control of the process.

Complementing primary production, ALUPCO (Saudi Aluminium Products Co.) stands out as the largest aluminum extruder in the Middle East. The company specializes in manufacturing architectural and industrial profiles, exporting its products to Europe, Africa, and the GCC region. Its extrusion, anodizing, and powder-coating capabilities demonstrate the sophistication of the country's aluminum processing industry.

The combined development of Ma'aden Aluminium and ALUPCO shows Saudi Arabia's ambition to build a complete and competitive industrial ecosystem, enabling it to secure a leadership role in the global aluminum market.

Saudi Arabia's food sector has established itself as a production and export hub in the Middle East, with companies that combine scale and efficiency to meet regional and global demand. The kingdom's strategy focuses on developing a robust and diversified agri-food industry that not only processes imported raw materials but also leverages its logistical capabilities to distribute branded products throughout the region.

At the forefront of the sector is Savola Foods, a leading producer of edible oils, ghee, and sugar products. With its well-known brand, Afia, the company has achieved a presence in more than 50 countries, demonstrating its international reach. Savola Foods operates large-scale refining and bottling plants, importing raw materials like oilseeds and crude oils to transform them into consumer goods. Its extensive supply-chain network is key to maintaining its dominant market position.

Complementing Savola, NADEC (National Agricultural Development Co.) stands out in the dairy and fats segment. The company produces butter, ghee, and cream, with strong export capabilities to Gulf countries. NADEC's major advantage is the integration of its operations with its own dairy farms, which ensures quality from the source. This vertical integration, along with the modernization of its facilities, strengthens its competitiveness in the regional market.

The growth and strength of companies like Savola Foods and NADEC demonstrate that the Saudi food sector is strategically positioned to meet the needs of a growing population while projecting its leadership in the global market.

Saudi Arabia's confectionery sector is a significant pillar of its food industry, with companies that combine rich history and modern technology to dominate the regional market. The presence of historical producers alongside global giants underscores the kingdom's position as a key hub for candy and sweet manufacturing and export.

Gandour, one of the oldest confectionery producers in the Middle East, stands out for its wide range of products, which includes biscuits, wafers, chewing gum, and chocolates. With facilities in Saudi Arabia, Lebanon, and Egypt, the company has the large-scale production capacity to export to markets in Africa, Asia, and the GCC. Its success demonstrates how companies with a solid local foundation can achieve regional and international reach.

Complementing Gandour's leadership, Mars Saudi Arabia brings global technology and top-tier quality standards. With a LEED-Gold certified factory in King Abdullah Economic City, the company produces chocolates like Galaxy®, exporting finished goods throughout the GCC region. Mars's investment in advanced facilities in Saudi Arabia demonstrates the confidence of global corporations in the kingdom as a strategic manufacturing hub.

The combined development of companies like Gandour and Mars highlights Saudi Arabia's ability to host and foster both long-standing local producers and global giants, cementing its leadership in the regional confectionery industry.